Topic

News about the global financial industry with a focus on developments in Hong Kong and China.

An upbeat assessment by Hong Kong’s financial secretary on initial public offerings to investment and attracting talent augurs well for city’s recovery.

As the Hong Kong stock market recovers from the gloom of the Covid-19 years, it looks forward to more IPOs, greater investment and fundraising.

Decision revealed by Chief Executive John Lee will allow shares to change hands even under the most extreme weather

Government-owned Hong Kong Investment Corporation teams up with local AI specialist SmartMore, with more hi-tech investments on the horizon.

- Hong Kong’s monetary authority will work with the Chinese central bank to enhance cross-border remittance services to make it easier for Hongkongers who work or retire on the mainland

A stable exchange rate plays a key role in China’s position as a major importer and exporter, but the yuan has come under heavy pressure from the US dollar.

Issues with Indonesia’s institutional capacity and governance could deter future investors, while legal changes may also be needed, analysts say.

The confidential agreement, which has yet to be publicly disclosed, is tied to the announcement on Wednesday by the DOJ that it is to recover an additional US$100 million in resolving two civil forfeiture cases.

The proceeds from new listings are down 35 per cent from a year ago and the lowest since the first half of 2003 when the Sars virus derailed the city’s markets.

‘When FTX collapsed, we saw the opportunity,’ says Ben Zhou, co-founder and CEO of Bybit.

The HKIC will use its initial corpus of HK$62 billion (US$8 billion) to support innovative start-ups, enhance economic growth and generate returns for the government.

Testifying before a supportive Congressional panel, the agency’s president asks for loosened restrictions to respond to Beijing’s export subsidies and finance.

The Supreme Court rejected a settlement with OxyContin maker Purdue Pharma that would have shielded members of the Sackler family, who own the company, from civil lawsuits.

President Ranil Wickremesinghe’s debt restructuring announcement seemed more like a campaign speech, analysts said.

An agreement with France’s central bank will make HKMA the first non-European participant in tests of the European Central Bank’s Eurosystem, which is exploring cross-border money transfer and settlement for tokenised assets.

Eight asset managers, including BlackRock, VanEck, Franklin Templeton and Grayscale Investments, are seeking to launch the funds.

Investors across the Asia-Pacific region are turning to gold, lured by its diversification and haven benefits at a time of uncertain economic growth and rising geopolitical risks.

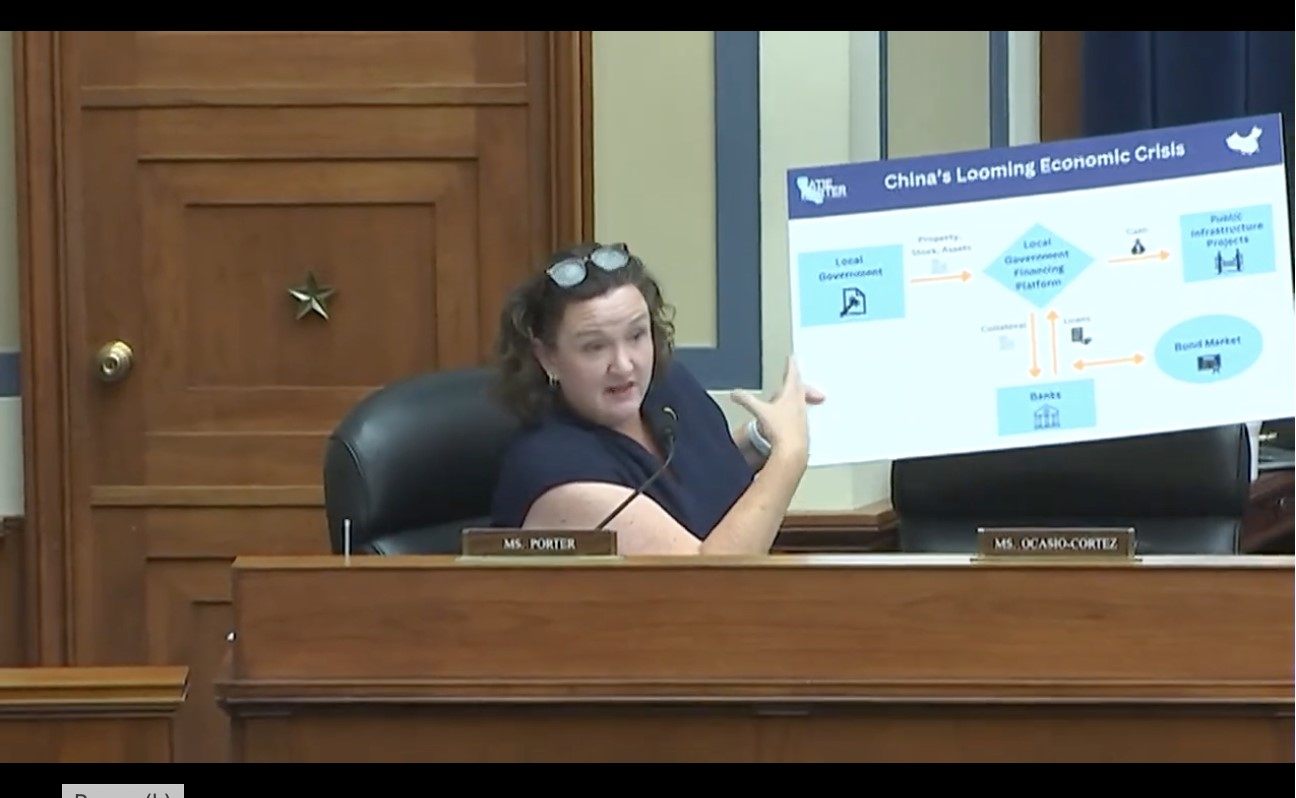

Ratings agencies S&P Global and Moody’s accused of failing to reflect risk posed by mainland’s local government financing vehicles.

The fugitive financier will also give up a luxury Paris flat and real estate and bank accounts in Hong Kong, Singapore and Switzerland.

High-level comments aim to shore up business and market confidence ahead of the economic-agenda-setting third plenum as foreign firms wait to see whether Beijing follows through.

YF Life is the first MPF trustee to move to the eMPF Platform, with the migration of all 12 providers set to be completed by the end of next year.

With yuan capital outflows at their highest in years, transfers from Hong Kong to mainland China appear to have done much to keep the currency from depreciating at much higher rates.

The city state is determined to combat money laundering and terrorism financing to safeguard its reputation, PM Lawrence Wong said.

Hozon is the latest to jump at the opportunity to raise funds abroad after China’s securities regulator opened the floodgates in mid-April to support qualified industry leaders to raise capital in Hong Kong.

DeFi and metaverse will open up opportunities for the financial services industry, Hong Kong Institute for Monetary and Financial Research executive says.

WeBank’s Hong Kong subsidiary will manage the digital lender’s overseas business, and offer services to countries and regions covered by the Belt and Road Initiative.

Report by China’s National Audit Office finds a wide range of problems in areas including social security benefits, credit allocation and local debt management.

The company has also updated China’s securities regulator officially about its change of listing venue, the sources say.

Hong Kong climbs one place to rank second in the world in Swiss bank Julius Baer’s study of the cost of living for high-net-worth individuals.

Company says it has secured multiple low-cost new loans to replenish its liquidity and increase the proportion of yuan loans as it seeks to control financing costs.

UBS will sell a 36.01 per cent holding in Credit Suisse Securities (China) for US$91.4 million to Beijing State-owned Assets Management Co.

Hong Kong has overtaken Singapore in terms of number of single family offices operating in the city, a senior government official said.

.jpg?itok=g1unXFZ7&v=1716951340)